“We are all but free range humans in a tax farm.” A mantra that is has been sung for centuries.

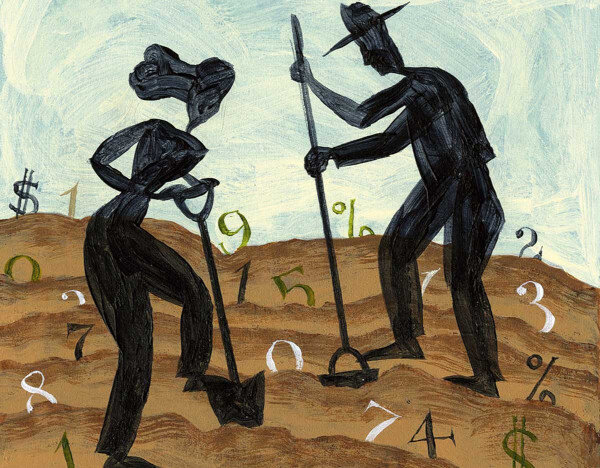

The idea and perception that we are being farmed for taxes is not a new idea or perception, especially in the current times of our society where the general public is being taxed to the Nth degree through complex tax codes (laws) that only the creators of those complex codes are able to understand.

In ancient Rome, tax collection was a vital aspect of governance and was often delegated to private individuals or groups known as publicani. These publicani were essentially contractors who bid for the right to collect taxes in a particular region or province on behalf of the Roman government. The system of tax farming, known as “publicanatus” in Latin, was prevalent during the Republic and the early Empire.

The phrase “tax farm” often refers to a system where a government grants the right to collect taxes of private individuals or entities in exchange for a fee. These entities then collect taxes from the population and keep a portion for themselves, remitting the rest to the government. Historically, this system has been associated with various forms of exploitation and abuse, as tax farmers often wielded significant power over the populace and could extract taxes through coercive or unjust means.

In contemporary terms, when people talk about the American people being used as a “tax farm,” they’re often referring to the perception that the government, through its taxation policies, disproportionately burdens its citizens to fund various programs and initiatives. Critics argue that the government can sometimes overreach in its taxation efforts, leading to a situation where individuals and businesses feel overtaxed or exploited.

Critics argue that the tax rates in the United States, particularly for certain income brackets or types of income, (such as corporate profits) are too high and hinder economic growth and individual prosperity.

The United States tax code is notoriously complex, leading to high compliance costs for individuals and businesses. Critics argue that this complexity benefits tax professionals and certain industries while burdening ordinary taxpayers.

Some argue that the tax system in the United States is inequitable, with certain groups or industries receiving preferential treatment or loopholes that allow them to minimize their tax burden. This favoritism can lead to resentment among those who feel unfairly taxed.

Critics of government spending argue that taxpayer money is often mismanaged or spent on inefficient or unnecessary programs. This can contribute to the perception that taxpayers are being exploited to fund wasteful government endeavors.

It’s obvious to anyone that has to buy anything from anywhere, including the abusive, absurd inclusion of 5 to 10 extra taxes imposed by city, county and state on anyone’s utility bill that the general population is fed up with being over taxed for the right to breath.

We are taught from an early age that we must get an education, go to work and….pay taxes as a form of right to exist, but to what extent is to much? Where is the line drawn on how much is to much? The answer lies in the governments procurement of the creators of the tax codes.

Some will even argue that you should pay taxes when you die. I’ll give you a minute to let that sink in. Unfortunately, it is a real law in the United States. You die, (as we all do some day) you are obligated to pay tax because you died.

The idea is that the government wants to collect as much money as possible and that if the person that died left a large chuck of change to next of kin, the government would be able to collect on that, never mind that the families are grieving the death of a loved one.

Of the most absurd is the governments latest tactic to collect taxes on criminals. You can think about that one for a minute too. Why would a “criminal” who breaks the law, as that is what criminals do, gleefully be so delighted to prance on down the local tax office to proclaim their earnings for the last kilo of cocaine they sold or the latest batch of jewels they stole and then sold.

It’s ridiculous to think that a government is so desperate to collect every penny out of thin-air that they would stomp around in your bank account without cause or a warrant.

But here we are, witnessing it first hand.